The reasons a Creditors’ Voluntary Liquidation is required (CVL)

If your business is insolvent and there seems to be no way out of your financial situation, a CVL could be the answer. It can help you escape the pressure from creditors and extract the most amount of money from your business for you to pay back your debts. As your licensed insolvency practitioner, we’ll do all the legwork and paperwork for you too.

Speak to our experts to see if a CVL is right for you.

So…what are the reasons a Creditors’ Voluntary Liquidation is required in business insolvency?

Your business doesn’t have enough money coming in

It’s quite normal for your business’ income to change throughout the year, especially if your trade relies on seasonal demand. But if you don’t have enough money saved to see you through the quiet periods, this is when you could run into trouble.

If poor cash flow is the cause of your insolvency, the reasons a Creditors’ Voluntary Liquidation is required is to stop any more debts building up, to liquidate your assets and to pay back your outstanding debts. In some cases, we can use a Start Afresh Liquidation to reopen your business and save your company name. Speak to our experts to see if this could be an option for you.

Bad financial planning

You might have a good amount of money coming into your business. But if you haven’t prepared for any changes in demand, the timings of your outgoing payments or late payment of invoices, you could still find yourself in an insolvent position. As a result, you might find yourself with disgruntled creditors demanding payments that you simply cannot make.

The reasons a Creditors’ Voluntary Liquidation is required in this situation is to stop the hassle from your creditors and destress the whole situation. Because a CVL is used to liquidate your company’s assets and pay back creditors, this is usually enough to stop them from pursuing you for the debt.

You’ve been putting your own funds into the business

Unfortunately it’s not uncommon for a director or owner to put personal money into the company to cover any shortcomings. As well as causing potential tax and credit issues, this puts a real strain on your personal funds.

It’s extremely difficult to make the decision to close your company after you’ve put your personal money into making it work. But there has to be a point where you stop.

One of the reasons a Creditors’ Voluntary Liquidation is required here is to extract any money the company has, in the form of its assets, and pay back the debts you’ve been trying to cover yourself. This in turn removes the immense strain this situation can cause.

Unmanageable debts

Company debts can slowly build and build, sometimes over a period of months, while you’re trying to make your business a success. When your company simply does not have the money to pay these debts – and your business doesn’t have the potential to make the money – this is one of the most common reasons a Creditors’ Voluntary Liquidation is required. By seeking a CVL, you can pay back as many of your debts as possible by liquidating your company’s assets. The debts that aren’t paid back are written off and you can walk away debt free.

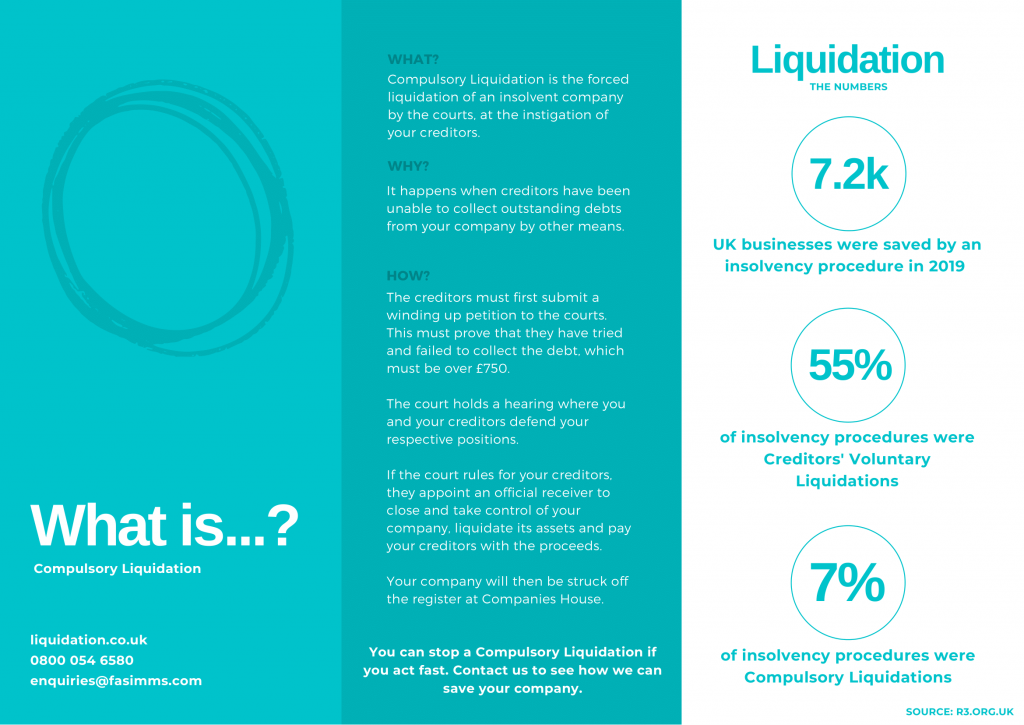

You’re being threatened with a winding up petition

When your business has a debt over £750 that it cannot pay, your creditors are likely to take increasingly serious action. While this might start with letters and a CCJ, it could end in a winding up petition being submitted to the courts and a Compulsory Liquidation instigated. At this point, you will have no control over the liquidation.

You can pre-empt this action by seeking a CVL before matters get to this point. You can even start a CVL after you’ve received the threat of a winding up petition.

How Liquidation.co.uk can advise you on the reasons a Creditors’ Voluntary Liquidation is required

We can help you understand the reasons a Creditors’ Voluntary Liquidation is required in your situation and guide you through the entire process. In some instances, we can use a CVL to save the parts of your business that work and restart it under a new company.

As industry leading experts with 40 years’ experience, we’re in the best position to match any like for like quote ensuring you receive the best service for the lowest price.

The reasons a Creditors’ Voluntary Liquidation is required

FAQs

What does insolvency mean?

‘Insolvency’ in a business sense means that a company cannot pay its debts on time or in full. It’s illegal for a company to continue trading when it’s in an insolvent position. There are ways to regain control of your business’ finances. Speak to our experts to see if we can help you get back into profit.

How do I know if my business is insolvent?

There are two ways to identify if your business is in an insolvent position.

The first is commonly called ‘The cash-flow test’. Essentially you need to look at your incoming payments and when they are due, then compare them to your outgoings. Can you meet your outgoings on time and in full? If not, your business is in an insolvent position.

The second test is ‘The balance sheet test’. This takes into account your business’ assets, including any stock, your premises, the value of your brand, money owed to you…anything that you can profit from. If you compare these to your liabilities, such as your debts and any leases you hold, and you get a negative figure, your business is technically insolvent.

What happens during a Creditors’ Voluntary Liquidation?

Before a liquidation can start, you need to hold a meeting of your shareholders and get approval for the liquidation from at least 75% of them. You’ll also need to agree on which licensed insolvency practitioner to appoint.

After the liquidation has been approved, your appointed licensed insolvency practitioner takes control of the company and runs the CVL process. This involves:

- Stopping the company from trading

- Getting its assets valued and selling them

- Distributing the resulting funds to creditors

- Investigating the cause of insolvency, including analysing the conduct of the directors

- Sending the relevant notifications to Companies House and The Gazette

What’s a winding up petition?

A winding-up petition is what’s submitted to the courts by your creditors when they intend to force the liquidation of your company in order to pay your outstanding debts. The court hears their case – and yours – and, if they find in your creditors favour, they issue a winding up order and appoint an official receiver to take charge of your company and continue with the Compulsory Liquidation

Review

There are no reviews yet. Be the first one to write one.