Benefits of insolvent liquidation.

What are the advantages and disadvantages of insolvent liquidation?

Facing insolvency is a difficult and often stressful time for business owners and company directors. But believe it or not, there are benefits of insolvent liquidation. We explore them for you below and look at why these benefits of insolvent liquidation might make it the right choice for you.

What are the benefits of insolvent liquidation?

STOP creditors pressuring you for payments

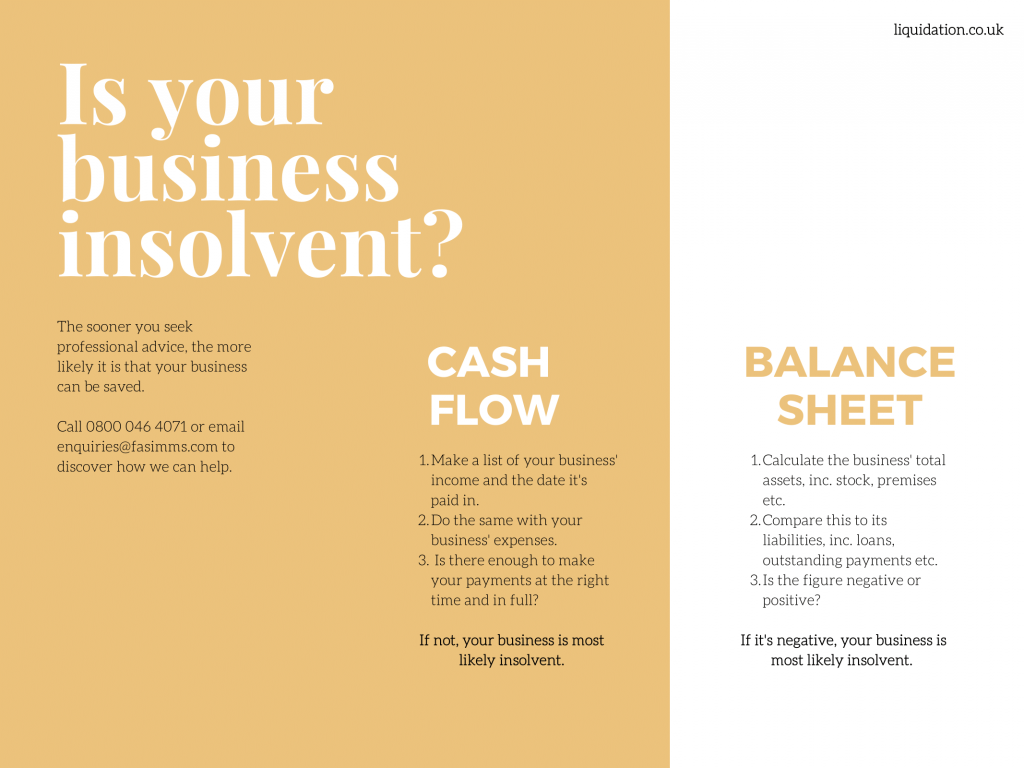

Often one of the first signs that your company is insolvent is that you have outstanding debts that you simply cannot afford to pay, now or in the future. The subsequent communications from these creditors, asking you to pay the money owed, can be tiring – even overwhelming.

You’ll find one of the benefits of insolvent liquidation is that this pressure from creditors is removed. A Creditors’ Voluntary Liquidation (CVL) effectively puts a barrier between you and your creditors – including HMRC – so that they can no longer contact you regarding payments.

STOP Compulsory Liquidation

If your business has been facing financial difficulties and you’ve been unable to pay your creditors, or reach an informal agreement to repay any debts on more favourable terms, you might find that you’re threatened with a winding-up petition. If you act quickly, you can stop this form of legal action being taken, the result of which is a Compulsory Liquidation that’s ordered by the courts.

Protection from legal action is one of the benefits of insolvent liquidation: by entering a CVL you can stop a winding-up petition from being issued to the courts.

STOP employees missing out

During the insolvent liquidation process, your company’s assets will be sold – or liquidated – to release funds that are then used to pay back money to those you owe it to. Initially this will be your secured creditors. If there’s any funds left, your employees will receive payment due to them, including outstanding pay (but not including redundancy or notice pay, which are not seen as secured debts).

It’s not unusual for there to be no funds left after repaying your secured creditors. Which means that your employees cannot be repaid their redundancy or notice pay by the company. One of the benefits of insolvent liquidation is that your employees can apply to the government to cover the statutory payments owed to them. This includes outstanding salary, holiday pay, redundancy and notice pay.

STOP the stress

For many company directors and business owners, this is the most important of the benefits of insolvent liquidation. If you’ve been dealing with the threat of insolvency and then the realisation that your company is insolvent, the worry can build and build. After all, the buck stops with you.

During a CVL, your appointed licensed insolvency practitioner will take control of the entire process, which includes dealing with angry creditors on your behalf. This effectively puts a barrier up between you and them, so you no longer have to handle the uncomfortable and stressful conversations.

What are the disadvantages of insolvent liquidation?

Your company ceases to exist

You started your company with the best intentions and worked hard to make it a success. So seeing it close after an insolvent liquidation can be a difficult time. However, one of the benefits of insolvent liquidation is that you don’t have to tackle this situation alone. Your licensed insolvency practitioner will be able to guide you through to make the process as smooth as possible.

Reasons for insolvency will be investigated

It’s your insolvency practitioner’s duty to look into the causes of insolvency as part of your insolvent liquidation. Unfortunately, if it comes to light that your or another company director has behaved in a way that’s against their responsibilities and has caused the insolvency, it could lead to prosecution and director’s disqualification.

Outstanding director’s loans must be repaid

Taking a loan from your company or having a company credit card or overdraft is common in business. Any outstanding debts to the company have to be paid back as part of the CVL process. Unfortunately, the director concerned is personally liable for this money and could find themselves facing personal financial difficulties if the money is not repaid.

Saying goodbye to your employees

Many businesses have employees who have given long years of service. While it can be an emotional time for them to see the company fail – and for you to let these employees go – one of the benefits of insolvent liquidation is that they won’t be out of pocket. Eligible employees can make a claim to the government to get any outstanding money owed to them from the company.

How can Liquidation.co.uk help you understand the benefits of insolvent liquidation?

We can help you understand the advantages and disadvantages of insolvent liquidation and talk you through your options. It’s important to remember that a company can sometimes be saved from liquidation, or a business saved and reborn through a new company.

As industry leading experts with 40 years’ experience, we’re in the best position to advise you of the most appropriate option for your business. We can also match any like-for-like quote ensuring you receive the best service for the lowest price.

Benefits of insolvent liquidation FAQs

What’s Creditors’ Voluntary Liquidation?

A Creditors Voluntary Liquidation is a formal liquidation process for insolvent companies. It’s used to liquidate a company’s assets and repay creditors with the resulting funds. The company is then closed. This process has to be overseen by a licensed insolvency practitioner.

What’s a winding-up petition?

A winding-up petition is an official notice given by creditors that they are planning to force a company to pay its debts (which must be more than £750) using legal means. This petition is sent to the court and, if it’s approved, results in a winding-up order being issued by the court to the debtor company. The court appoints an official receiver who will liquidate the company through a Compulsory Liquidation. Given the benefits of insolvent liquidation, it’s best to proceed with a CVL before things get to this stage.

What’s a secured creditor?

One of the benefits of insolvent liquidation for your creditors is that they can get all or some of their money back. There’s a hierarchy of creditors which dictates when they are paid back. This is the overview of who will be paid first:

- Secured holders, including banks.

- The liquidator takes their fee and the expenses of liquidation are paid.

- Preferred creditors. Employees are in this group but only wages and holiday pay.

- Unsecured creditors, including HMRC.

- Shareholders

What’s a director’s disqualification?

If you or another director is involved in any of the below, and are successfully prosecuted, it will result in being disqualified from being a director or holding any management position in a company for up to 15 years. This can also be accompanied by a prison sentence in serious cases.

- Wrongful trading (trading while knowingly insolvent)

- Failing to keep accurate and complete accounts and records.

- Failing to pay taxes to HMRC.

- Failing to file company accounts and tax returns.

- Using company money for personal gains.

Review

There are no reviews yet. Be the first one to write one.